The International Fuel Tax Agreement (IFTA) simplifies fuel tax reporting for carriers operating across multiple U.S.states and Canadian provinces. Instead of filing separate tax reports in each jurisdiction where they purchase fuel or drive miles, carriers file one quarterly IFTA report through their base state. That state then redistributes the taxes owed to other jurisdictions.

The IFTA fuel tax report must accurately capture miles traveled and fuel purchased in each state or province. The system calculates how much fuel tax each area owes based on your fleet’s activity. While designers created the system to make life easier for interstate carriers, preparing these reports can still feel overwhelming, especially if you manually track miles, log fuel purchases, and manage paperwork. Mistakes or incomplete records don’t just cost you time; they can lead to audits, penalties, or delays in receiving credits. For small fleets and owner-operators, the quarterly task of IFTA reporting often feels like unnecessary stress on top of running your business.

The Challenges of Manual IFTA Reporting

Traditionally, drivers or fleet managers track mileage manually using odometer readings, logbooks, or spreadsheets. We gather fuel purchases from paper receipts or monthly fuel card reports. Once we collect this data, we sort it by state or province, check it for accuracy, and format it correctly on the IFTA reporting form.

Even a small mistake, missing miles, fuel discrepancies, or jurisdictional errors, can lead to costly issues during an IFTA audit. What should be a routine administrative task becomes a weekend-consuming headache.

How TruckX Simplifies IFTA Reporting

TruckX’s platform tracks the miles traveled per jurisdiction. This data is stored securely and accurately in your account, making quarterly reporting faster and more reliable.

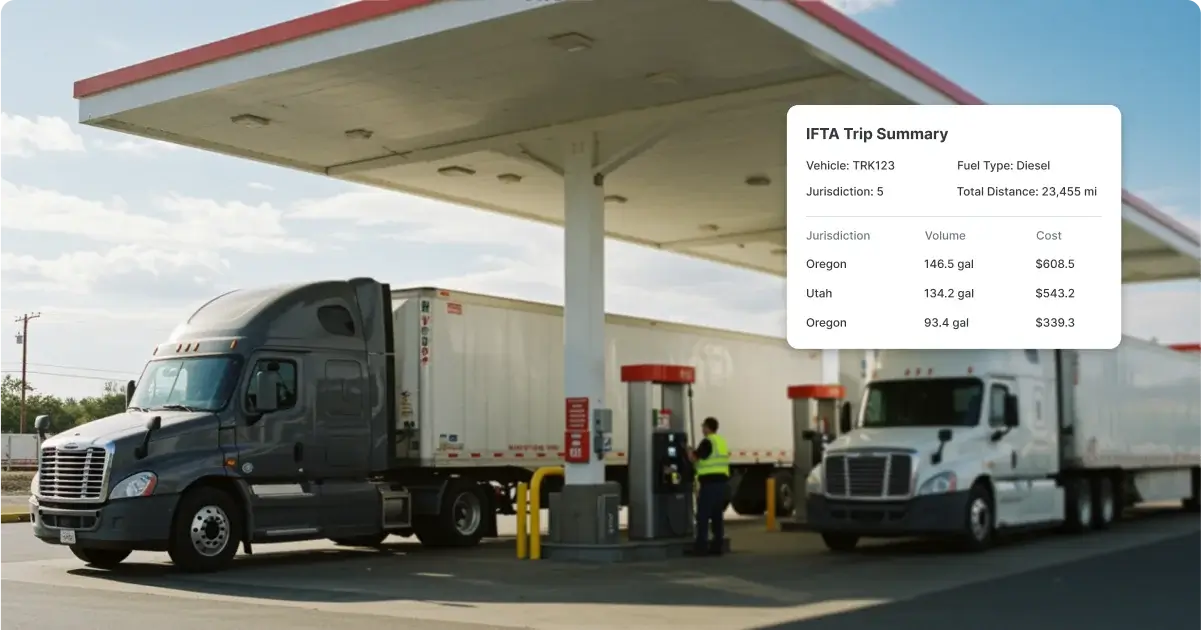

With just a few clicks, you can generate your IFTA fuel tax report using TruckX’s dashboard. Your report will clearly break down the miles driven in each state or province, exactly what you need for filing your IFTA paperwork or uploading data into your state’s filing portal.

How TruckX Automates IFTA Reports in Minutes

Automatic State-Line Mileage Capture

TruckX’s ELD captures every jurisdiction crossing in real-time. This ensures your IFTA reporting is based on precise, automated data tied directly to your vehicle’s engine and location. There’s no guesswork involved; your miles are accurately categorized by state as you drive.

IFTA Report Generation

When quarter-end comes, simply log in to your TruckX dashboard, select your reporting period, and generate your IFTA fuel tax report form. Your mileage data is automatically compiled into a clear, formatted structure that meets the needs of your base jurisdiction for submission.

This process eliminates manual calculations, reducing the risk of errors and saving valuable time. TruckX ensures your data is ready for export and accepted by most state agencies.

Why TruckX is the Smart Choice for IFTA Reporting

For owner-operators and small to mid-sized fleets, compliance tasks like IFTA reporting shouldn’t steal hours from your schedule. TruckX provides a simple, reliable solution by automatically capturing the data you already need for IFTA and packaging it in a way that’s easy to file.

You won’t need complicated spreadsheets, manual calculations, or separate software tools. With TruckX, your IFTA fuel tax reporting is fast, accurate, and stress-free.

Conclusion

IFTA compliance is a necessary part of operating across state lines, but it doesn’t have to be a burden. TruckX simplifies the complexity of quarterly IFTA reports by automating your jurisdictional mileage tracking and streamlining your reporting process into just a few clicks.

Spend less time worrying about paperwork and more time running your fleet. Let TruckX handle the details so you can focus on what matters: driving your business forward. To learn more, visit TruckX.com or call +1 (650) 600-6007 today.